This article aims to provide an exclusive look into Monaco’s wealth management services, potential investment decisions, for discerning HNWIs and UHNWIs and their financial managers and advisors. The focus is to present an overview of the possible investment strategies, tax planning, estate planning. These strategies could be beneficial to protect your asset, manage risk, and devise short term and long term financial goals.

What are the Financial Needs of UHNWIs and HNWIs?

The financial situation of UHNWIs and HNWIs is multifaceted and complex, requiring a comprehensive and tailored approach to wealth management. Here’s a closer look at some of these needs:

- Comprehensive Financial Planning: HNWIs and HNWIs need detailed financial plans that outline their personal and family values and goals. This involves making financial forecasts based on these factors and creating strategies to protect their wealth.

- Investment Management: HNWIs and HNWIs often require sophisticated investment management services. Notably, UHNWIs are likely to put their money in direct investments. They also need access to hedge funds, private equity, and other alternative investments.

- Tax Advice: Given the significant share of income tax revenue that UHNWIs contribute to the national budget, managing their tax liabilities effectively is a top concern. This requires expert tax advice and planning.

- Trusts and Estates: Estate planning, including the creation and management of trusts, is another crucial aspect of financial services for HNWIs.

- Risk Management: With their substantial wealth, UHNWIs and HNWIs face unique risks. These include the volatility of stock markets and other investment platforms. Therefore, they need robust risk management strategies to safeguard their assets.

Altoo also offers tailored solutions for Monaco’s financial landscape to address the complex needs of HNWIs and UHNWIs. Leveraging cutting-edge technology and expert insights, Altoo provides a comprehensive suite of services ranging from customised financial planning to specialised investment opportunities.

Asset Protection and Estate Planning in Monaco

Monaco is not only a glamorous and opulent destination, but it is also a stronghold for robust asset protection and advanced estate planning solutions. HNWIs and UHNWIs are seeking foolproof ways to secure their wealth for generations.

Your Wealth, Our Priority: Altoo's Consolidation Power, Secure Document Management, and Seamless Stakeholder Sharing for High Net Worth Individuals. Preview Platform.

Monaco-Based Trusts and Foundations

In Monaco, the concept of trusts and foundations is uniquely designed to offer maximum asset protection and facilitate intricate estate planning. While Monaco is not a common law jurisdiction, it is a signatory to The Hague Trust Convention, thereby giving trusts a legal footing within the Principality. It should be noted that Monaco-based trusts can potentially offer:

- Privacy: Your financial affairs are kept confidential, away from public scrutiny.

- Asset Protection: Against litigious claims, divorce proceedings, or insolvency scenarios.

- Tax Benefits: Monaco offer favourable tax implications for trusts, particularly for residents.

Trusts and Foundations in Monaco: A Tax and Succession Overview

Understanding Monaco’s trust and foundation laws is essential to navigating them. Here is a brief rundown of the most relevant aspects:

01 Trusts in Monaco

- Recognition: Monaco recognises foreign trusts under the Hague Convention of 1 July 1985. Domestic trusts can be created under Law n°214 of 27 February 1936.

- Taxation: Varies based on the number of beneficiaries. The duty ranges from 1.3% to 1.7% on the property in the trust.

- Succession: Trusts are subject to Monaco’s forced heirship laws, implying that they cannot bypass the rights of the forced heirs.

02 Monégasque Foundations

- Recognition: Permitted, but must be authorised by a sovereign order. They should meet public policy and national security standards and have sufficient funds.

- Taxation: Generally exempt from estate and gift taxes

- Succession: Foundations, like trusts, cannot bypass Monaco’s forced heirship rights. Assets exceeding the available portion of the estate are subject to heirship laws.

By considering these key aspects, HNWIs and UHNWIs can make more informed decisions on asset protection and estate planning in Monaco. However, it is always advisable to consult with a qualified financial advisor for tailored strategies.

Estate Planning in Monaco

Estate planning in Monaco goes beyond drafting wills; it’s about crafting a financial legacy. HNWIs and UHNWIs have the option to integrate Monaco-specific financial vehicles into their estate planning strategy, which may include:

- Investment Portfolios: Diversification by including Monaco-based assets

- Life Insurance Contracts: Tailored to offer specific benefits, such as fixed annuities

- Real Estate Holdings: The use of Monaco real estate as an investment avenue, structured for optimal tax benefits

While these strategies could be compelling, individual circumstances vary, necessitating bespoke financial strategies.

Why Asset Protection and Estate Planning are Crucial

Asset protection and estate planning are indispensable tools for the long-term financial health of HNWIs and UHNWIs. In volatile market conditions, these services aim to secure assets and provide a financial cushion against unforeseen events.

Estate planning is not just for end-of-life considerations It is a dynamic process that may allow for the reassessment and reallocation of assets, potentially ensuring they are optimally structured for current needs and future ambitions.

Connectivity and Global Outreach

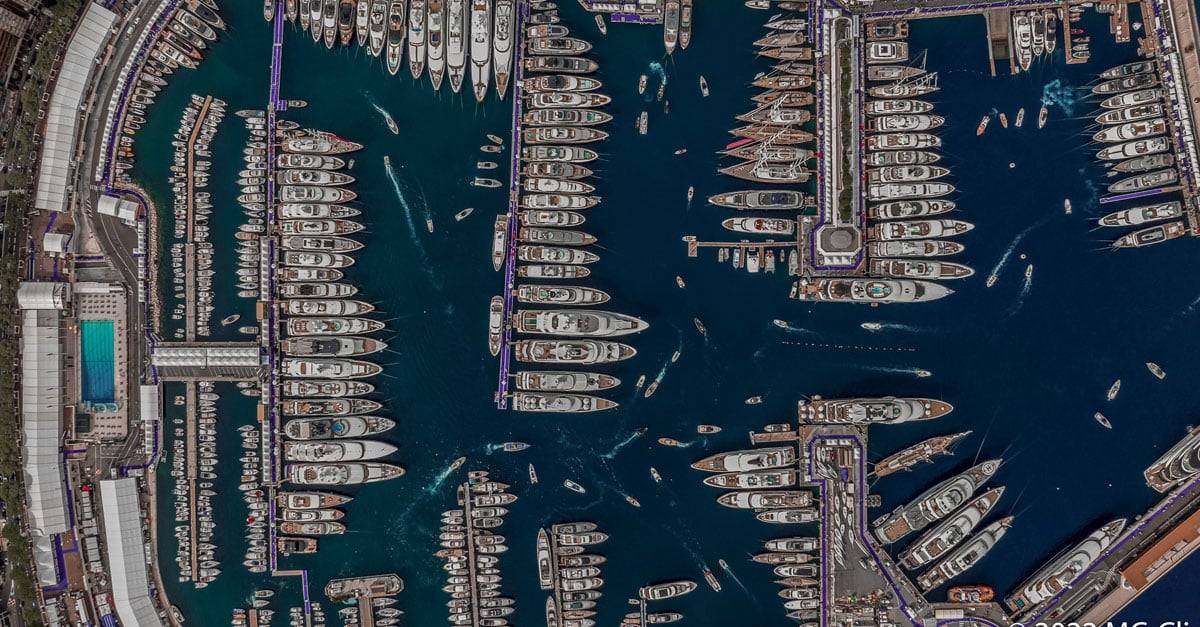

In an increasingly globalised financial landscape, location is not just a matter of geographical convenience but a strategic advantage. Monaco’s unique position near some of the world’s leading financial hubs elevates its allure for HNWIs and UHNWIs.

The Strategic Edge of Monaco’s Location

Monaco possesses a unique advantage because of its strategic location. Situated near vital European financial hubs like London, Zurich, and Frankfurt, the country offers more than just fiscal benefits; it provides quick and effective access to an array of financial resources and opportunities.

Why Proximity to Financial Hubs Like London, Zurich, and Frankfurt Matters

- Swift Market Engagement: Monaco’s closeness to leading financial centres enables quick decision-making in volatile trading conditions. Whether it’s making an investment in the London Stock Exchange or capitalising on financial trends emanating from Zurich, rapid action is made easier.

- Expanded Networking and Partnerships: The abundance of networking events and industry forums in adjacent cities like Zurich and Frankfurt create fertile grounds for strategic alliances and business expansion.

- Access to Expert Resources: Monaco’s strategic location allows advisory teams to tap into a wide array of financial expertise without the need for prolonged travel. Whether you’re looking to consult an investment banker in London or a hedge fund manager in Frankfurt, experts are just a short distance away.

Leveraging Monaco’s Geographical Advantage

Financial advisors and managerial teams catering to HNWIs and UHNWIs may consider:

- Quick Decision-making: Utilise Monaco’s proximity to other financial hubs for fast, informed analyses of market trends. This could be especially relevant for those involved in real-time trading or those who need timely financial advice.

- Strategic Networking: Proactively engage in business events and financial forums in nearby financial centres to foster partnerships and gain insights into the latest market trends.

Though Monaco’s location offers a multitude of potential advantages, outcomes may vary based on a variety of factors.

Quality of Life: An Integral Part of Wealth Management in Monaco

When considering the comprehensive wealth management ecosystem of Monaco, the quality of life emerges as an undeniably attractive feature. The wellbeing of a HNWIs or UHNWIs extends beyond mere numbers on a balance sheet. Here’s how Monaco’s living conditions, replete with luxury and security, complement its financial benefits.

Living in Monaco: A Confluence of Luxury and Security

- Unmatched Luxury: Residences in Monoca offer panoramic sea views and are equipped with high-end amenities that cater to the sophisticated tastes of wealthy individuals. Such an environment not only enhances daily living but also serves as a backdrop for valuable social interactions, thereby potentially elevating one’s status and opportunities.

- High Standards of Security: Monaco is renowned for its low crime rates and high levels of security, which is especially pertinent for UHNWIs concerned with personal safety. The peace of mind this offers could be invaluable when it comes to making level-headed financial decisions.

- Global Community: The principality’s cosmopolitan atmosphere provides rich cultural interactions and global networking opportunities. From meeting industry leaders at a gala to forming alliances at exclusive clubs, the social circle here is as enriching as it is diverse.

- Healthcare and Education: State-of-the-art medical facilities and world-class educational institutions are readily available, ensuring that both health and knowledge—the ultimate assets—are well taken care of. Monaco has the highest life expectancy in the world.

While the luxurious lifestyle and high security in Monaco offer a potentially advantageous environment for HNWIs and their advisory teams, the quality of life is subject to individual preferences and needs.