Many aspects to consider

The transition from one generation to the next is a difficulty that requires the entire family and its counsellors. Everyone should be on the same page. Those who pass on wealth are just as interested in appropriate succession planning as those who take it over. However, the generation in command may, naturally, be reluctant to relinquish control of its operations. Furthermore, it may be concerned about overburdening the next generation by transferring too much duty at once.

On the other hand, the new generation may be eager to take over that task and would want to expedite the process; nevertheless, it is frequently stymied because they lack access to knowledge. This can be especially unpleasant if the family has a business that requires one person to be entirely in control.

In addition to psychological hurdles to succession planning, poor paperwork further complicates issues. Many people still keep papers or excel files, worse, some data may not be recorded at all. This offers a single-person risk: if the person guarding the information dies unexpectedly or suffers from memory loss, the data may be permanently lost.

Technology as a mediator

All parties concerned should look for a well managed procedure to avoid the hazards of inadequate succession planning. The good news is that technology has greatly simplified this procedure. Platforms for managing wealth offer complete solutions to the problems that lie ahead.

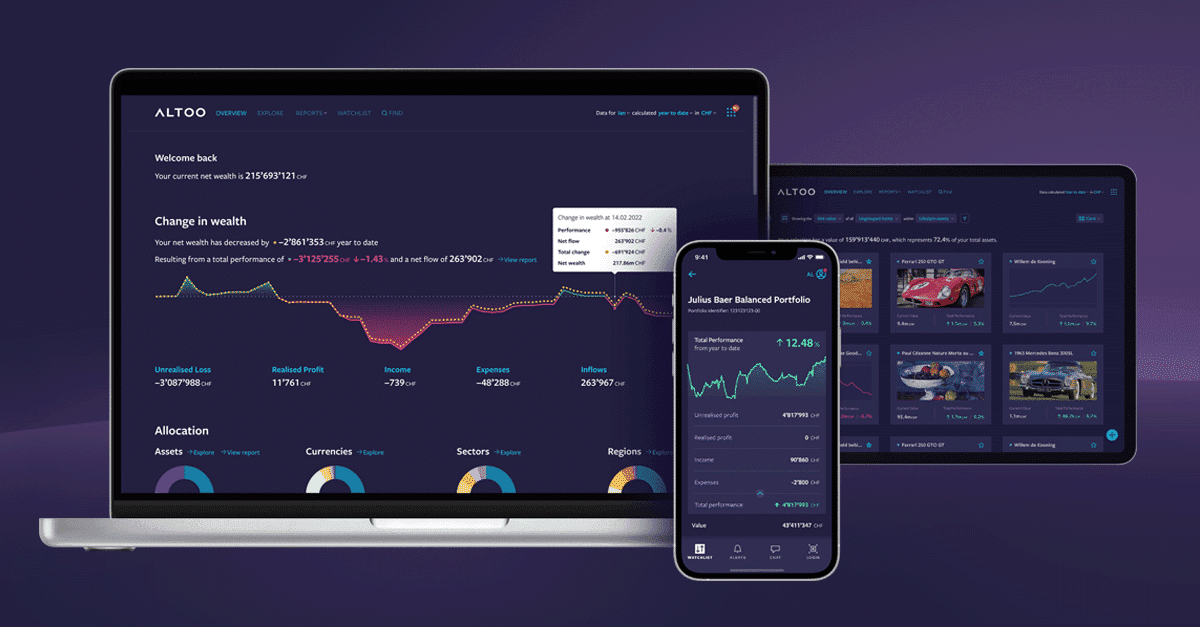

Elevate Your Wealth Game: Empowering UHNWIs for Simplified Asset Management. Altoo Platform Preview

In the old days, passing on wealth meant discussing account statements, paper folders or excel sheets, explaining what the family owns. The greater the wealth, the more complex the handover. Information and important documents might disappeared.

Technology can significantly lower this danger. Users of contemporary wealth management platforms can save all of their data in a digital vault. The digital vault offers a single data centre where everything is kept, whether it be ownership documents, mortgage contracts, insurance policies, or account statements. Owners of accounts may choose which files, resources, and documents they wish to make available to other users at specific times. As a result, family leaders might grant their offspring access to some of the family’s riches without overwhelming their successors with information. They may then divulge additional knowledge, giving the younger generation some time to adjust to its new position.

Wealth management software acts as a bridge across generations as a result. It gives those who inherit money access to information and for those who came before them, it allows for the gradual sharing of responsibility. Digital platforms also offer protection for both parties against the untimely demise of the person who is responsible for keeping all information safe. Data won’t be lost; rather, it will be well-organized, current, and accessible. Family secrets and assets are kept private.

More than just data aggregation

In most cases, the incoming generation will be more open to using digital technologies. At the same time, current wealth holders might prioritise the paper-based filing systems they have used for a lifetime. Wealth management platforms need to address privacy and security concerns, provide a secure infrastructure, and have user-friendly interfaces. It’s also paramount that account owners can share information with their successors and involve external advisors such as tax or real estate consultants.

Altoo’s award-winning Wealth Platform is an example of advanced software that provides private and institutional clients with a holistic view of their wealth. It offers an intuitive dashboard that provides clear, real-time information on all assets as well as vital market data. This real-time knowledge aids decision-making, reduces the likelihood of anything being overlooked, and aids in maintaining a well-balanced, diversified portfolio.

Technology makes the difference

The benefit of a wealth management tool like Altoo is that the programme can accommodate a variety of circumstances. Some high-net-worth and ultra-high-net worth individuals, for example, may prefer to directly manage their financial affairs, but others may hire specialised individuals or establish a single-family office to manage their money on their own. That’s why the ideal wealth management platform is more than just a data aggregator. It’s an interactive platform where all involved stakeholders can communicate and participate. It’s a single point of truth and a tool that makes passing the legacy to the next generation easy. While professional estate planning remains essential, technology can provide solutions to one of the biggest intergenerational challenges facing wealthy families.